Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Coverage Program

Relevance of Affordable Home Insurance

Protecting budget friendly home insurance policy is essential for protecting one's residential property and financial wellness. Home insurance policy provides defense versus various risks such as fire, burglary, all-natural disasters, and individual liability. By having a comprehensive insurance policy plan in place, homeowners can feel confident that their most considerable financial investment is secured in the event of unpredicted scenarios.

Inexpensive home insurance not just gives monetary security yet also supplies assurance (San Diego Home Insurance). When faced with climbing building worths and building prices, having a cost-efficient insurance policy ensures that property owners can easily reconstruct or fix their homes without dealing with substantial financial worries

Moreover, budget friendly home insurance can likewise cover personal belongings within the home, providing repayment for items harmed or swiped. This insurance coverage expands beyond the physical framework of your home, shielding the components that make a house a home.

Protection Options and Boundaries

When it involves coverage limits, it's vital to recognize the optimum amount your policy will certainly pay for each and every kind of coverage. These limitations can vary relying on the plan and insurance company, so it's vital to examine them very carefully to guarantee you have sufficient protection for your home and possessions. By recognizing the insurance coverage choices and limits of your home insurance coverage, you can make educated choices to safeguard your home and loved ones effectively.

Factors Affecting Insurance Policy Prices

Several variables significantly influence the expenses of home insurance coverage policies. The area of your home plays a crucial role in determining the insurance policy premium.

Additionally, the kind of coverage you choose directly affects the price of your insurance coverage. Selecting added insurance coverage choices such as flood insurance coverage or earthquake coverage will certainly enhance your costs. Selecting higher insurance coverage restrictions will certainly result in higher prices. Your insurance deductible quantity can likewise impact your insurance costs. A greater deductible typically indicates reduced costs, but you will certainly have to pay more out of pocket in the occasion of a claim.

Furthermore, your credit report, declares history, and the insurance provider you choose can all influence the price of your home insurance plan. By considering discover this info here these factors, you can make educated decisions to help handle your insurance coverage costs successfully.

Comparing Companies and quotes

Along with contrasting quotes, it is essential to review the track record and economic stability of the insurance providers. Seek consumer reviews, rankings from independent agencies, and any type of history of grievances or regulatory activities. A reputable insurance coverage copyright should have a great record of promptly processing insurance claims and providing exceptional consumer service.

Additionally, consider the certain insurance coverage features supplied by each copyright. Some insurers might provide fringe benefits such as identification burglary security, equipment breakdown coverage, or protection for high-value items. By thoroughly contrasting quotes and companies, you can make an informed choice and select the home insurance policy plan that ideal satisfies your demands.

Tips for Saving on Home Insurance

After extensively comparing quotes and carriers to find the most ideal protection for your demands and budget plan, it is sensible to explore reliable strategies for conserving on home insurance policy. One of one of the most considerable ways to reduce home insurance is by packing your plans. Lots of insurance policy firms offer discounts if you acquire multiple policies from them, such as integrating your home and auto insurance policy. Raising your home's security procedures can also cause financial savings. Mounting safety systems, smoke detectors, deadbolts, or a lawn sprinkler system can decrease the danger of damages or theft, potentially decreasing your insurance policy premiums. Additionally, keeping an excellent credit report can positively affect your home insurance prices. Insurers frequently think about credit rating when establishing costs, so paying bills in a timely manner and handling your debt properly can result in reduced insurance costs. Finally, routinely assessing and upgrading your policy to mirror any kind learn this here now of adjustments in your house or circumstances can guarantee you are not spending for insurance coverage you no more demand, assisting you conserve cash on your home insurance policy premiums.

Final Thought

In conclusion, protecting your home and loved ones with cost effective home insurance policy is critical. Implementing tips for saving on home insurance coverage can likewise help you protect the required protection for your home without breaking the financial institution.

By unraveling the complexities of home insurance coverage plans and discovering sensible strategies for safeguarding inexpensive protection, you can make sure that your home and liked ones are well-protected.

Home insurance coverage plans commonly supply a number of insurance coverage alternatives to protect your home and personal belongings - San Diego Home Insurance. By understanding the insurance coverage options and limitations of your home insurance coverage policy, you can make educated choices to secure your home and liked ones successfully

Frequently examining and updating your plan to mirror any kind of modifications in your home or circumstances can guarantee you are not paying for coverage you no longer need, aiding you save cash on your home insurance costs.

In conclusion, securing your home and loved ones with economical home insurance policy is important.

Ariana Richards Then & Now!

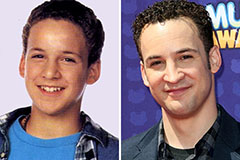

Ariana Richards Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!